Clear Your Debts With A Trust Deed

No Set Up Fees

Completely Confidential

One To One Contact

Authorised Insolvency Practitioner

Our form takes less than 60 seconds to complete!

We only process the information you give us to satisfy your enquiry.

Clear Your Debts With A Trust Deed

No Set Up Fees

Completely Confidential

One To One Contact

Authorised Insolvency Practitioner

Our form takes less than 60 seconds to complete! Your privacy is guaranteed.

CLICK TO CALL US ON 0800 193 5080

What is a Trust Deed?

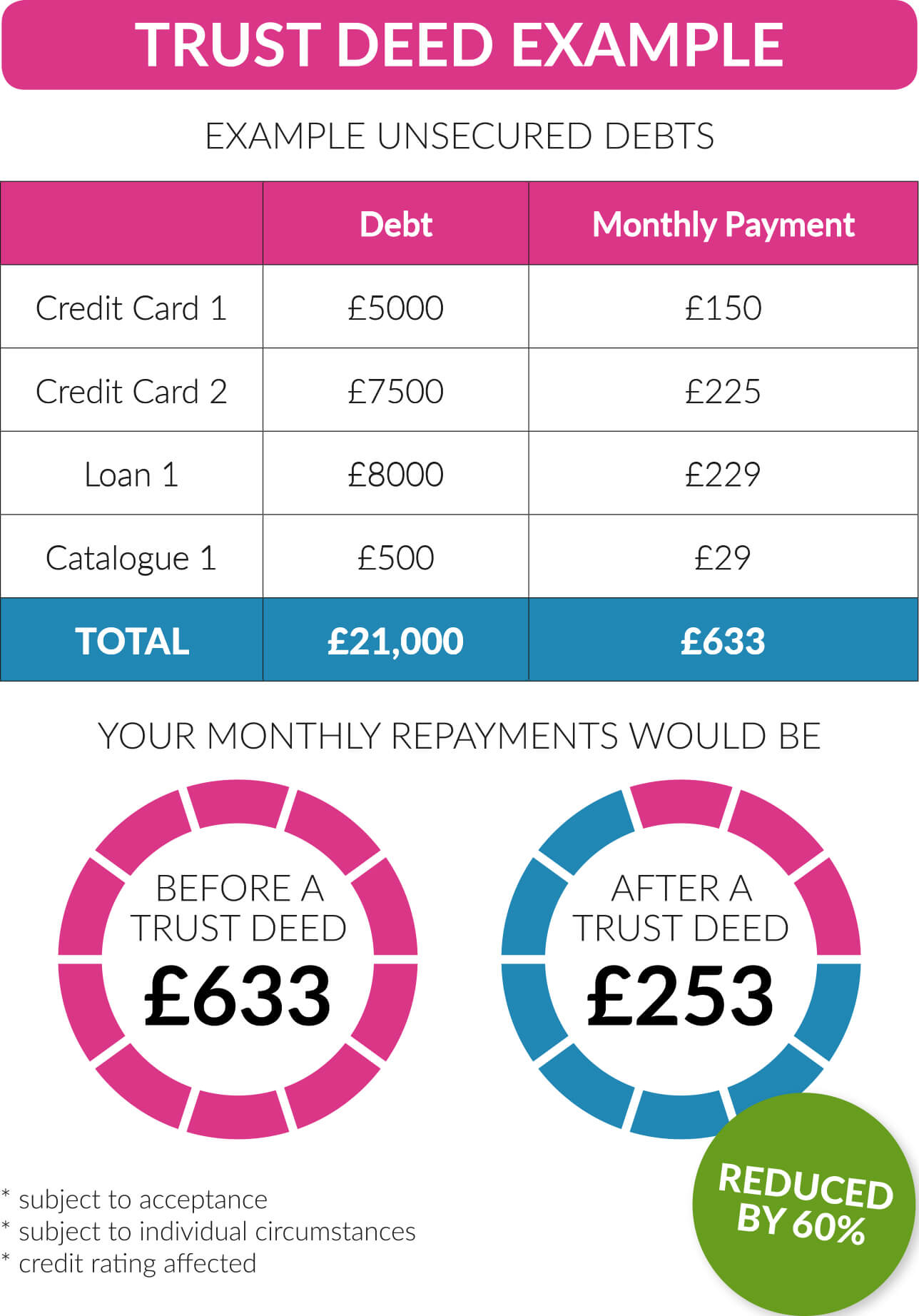

A protected trust deed is a legally binding arrangement in Scotland where you make reduced payments usually over a period four years. At the end of this time, your unsecured debts are usually written off.

A trust deed is a form of insolvency, so your unsecured debts need to outweigh the value of your assets, such as a house or vehicles. Unsecured debts include things like credit card debt, personal loans, payday loans and store cards.

Trust deeds are only available if you live in Scotland. If you live in England, Wales or Northern Ireland, an Individual Voluntary Arrangement (IVA)is a similar solution, but it’s important to note that it has different benefits, risks and fees associated with it.

Benefits of Trust Deeds

Our form takes less than 60 seconds to complete! Your privacy is guaranteed.

L Roberts left 5 star rating ★★★★★

*5 Star Google rating correct at time updated Sep 2020

Other important things to consider with protected Trust Deeds

How will a trust deed affect me?

Alternative debt solutions

Debt Arrangement Scheme

The Debt Arrangement Scheme is a debt management tool only available in Scotland. It lets you apply for a debt payment programme (DPP) which helps you repay your debts by making affordable monthly payments. DPPs can only be set up by an approved organisation such as StepChange Debt Charity. We can help you set up a DPP, and unlike some debt advice companies, we don’t charge any fees to set one up.

Benefits of a DPP

Risks of a DPP

Minimal Asset Process

A minimal asset process (MAP) bankruptcy gives you a fresh start by writing off debts that you can’t repay within a reasonable time. It’s aimed at people with a low income and not many assets and is cheaper and more straightforward than sequastrion bankruptcy. You can only apply for MAP through an approved money advice organisation, like us. Unlike many other companies, we’ll set up and manage your MAP free of charge.

Benefits of MAP

Risks of MAP

✔ Some private landlords may evict tenants or not renew a tenancy agreement if you become bankrupt

✔ Some debts, such as student loans, on-going child maintenance and court fines are not included

✔ If you’re self-employed, bankruptcy could make it harder to trade and obtain credit for goods and services

Sequestration

Sequestration is a form of insolvency and may be suitable if you can’t pay back your debts in a reasonable time. Assets you own, such as your house or car, could be sold to pay off your debts.

If your assets are worth more than your debts, or if all of your regular payments are up to date and you can afford to keep paying them, sequestration may not be the right solution for you.

Minimal Asset Process (MAP) Bankruptcy is cheaper and can be more straightforward than sequestration bankruptcy and may be an option to consider.

While sequestration may be the best solution to deal with your debts it’s important to understand the benefits and risks associated with it.

Benefits of Sequestration

Risks of Sequestration

To find other sources of free advice visit Money Helper. It’s here to listen and give free, impartial, trusted guidance. Based around you and backed by government. You can find out more about dealing with your creditors in a guide produced by the Insolvency Service: In Debt – Dealing with your creditors.

DEBT SOLUTIONS

Individual Voluntary Arrangement

What is an IVA?

An IVA, or individual voluntary arrangement, is a legally binding agreement between you and your creditors, in which you agree to pay an affordable monthly payment for a set period of time – usually 5 or 6 years. After this set period of time any remaining debt will be written off. Your credit file could be affected for 6 years.

Will an IVA affect my property?

For homeowners regulations state that if you have equity, some form of equity release may be required by creditors. If you do not have equity or you can’t re-mortgage, you will most likely have an extra 12 months of payments added on to your IVA.

How will an IVA affect you?

When you enter an IVA, your creditor accepts what you can afford to pay over the course of 5 years. Once that time period is up, your outstanding balance is written off. This amount could be up to 75% of your initial debt balance.

Your ability to obtain credit for credit cards, loans, mortgages and other unsecured debts may be affected for 6 years. An IVA will be on your credit report for a minimum of 6 years from the date of arrangement and longer if the arrangement lasts more than 6 years.

Your IVA will be added to the Insolvency Register and is removed 3 months after the IVA ends.

Who can set up an IVA?

An IVA can only be set up by a qualified professional, person known as an Insolvency Practitioner (IP).

What fees are payable if I decide to apply for an IVA

If we determine that an IVA is a suitable option for you and you agree, we will fully explain the fees involved. This is summarised in the Fee Policy below.

What happens during an IVA?

An IVA involves making a profile of your financial situation and making contact with all of your creditors. During a meeting with all of your creditors, your proposed monthly payment will be voted on. As long as 75% of your creditors agree upon the amount you proposed, your IVA will be approved. The proceeds from the monthly payment sent to your insolvency practitioner each month will then be divided among your creditors (this is distributed based on your debt level with each creditor).

Benefits

- Gives you a date on which your debt will be cleared.

- Stops letters and phone calls from your creditors.

- Stops debt collectors and bailiffs from calling you.

Disadvantages

- You will be obligated into the agreement for the full term.

- Your details will be recorded on the insolvency register.

- You will not be able to get additional credit of more than £500 without your supervisor’s consent.

- Homeowners will need to look into releasing equity from their home.

- Failure to comply with the IVA may lead to bankruptcy.

- Your credit file may be affected for six years.

- Certain debts will still be outstanding.

Debt Management Plan

What is a debt management plan?

When you are looking into how to solve your debt problems, you hear the term ‘debt management plan’ and many people have absolutely no idea what one actually is.

A debt management plan is an informal arrangement where providers come to an arrangement with your creditors to repay your debts, but at a rate which you can afford. They do this by looking at your income and expenditure and coming up with a realistic payment plan that is good for all parties – your creditors get paid in full and you can repay your debts without struggling for food or warmth. If your situation changes and you can afford to pay more (or less) you can change your payment amount quickly and easily. Alternatively if at any point you decide you no longer need to be on a debt management plan you can cancel at any time, although you will still have any outstanding debt with your creditors. In many cases Debt Management providers can even have any charges and interest frozen, although there is no guarantee that the creditors will agree to this. A Debt Management plan is not a solution we administer in-house.

What are the fees for debt management?

Some debt management companies charge you a monthly debt management fee to pay the daily administration of your plan, the assistance from an expert agent, setting up communication with your creditors, payment of postal fees and phone calls, requesting that interest and other charges be stopped and providing you with an annual review of your financial situation. However you can obtain this service for free from a charity such as Stepchange.

How do you set up a Debt Management Plan?

The debt management company will conduct a full financial review of your accounts and determine a monthly affordable payment. They will then communicate directly with your creditors on your behalf, and develop a repayment plan. Once the plan is in place, all you will need to do is make one monthly payment. We will always recommend you speak to The Money Advice Service for free & impartial money advice before speaking to a debt management company.

Can I pay off my debts early?

A debt management plan does allow you to pay off debt early. As a non-legally binding agreement, you will be allowed to use pay rises or other sources of income to make larger payments and relieve yourself of debt sooner.

Benefits

- Your plan is flexible so payments can be changed to meet your circumstances.

- If you complete the plan, your unsecured debts will be cleared.

- Making one regular monthly payment allows you better control over your finances.

- In many cases, you will no longer be contacted by your creditors or debt collectors.

Disadvantages

- Creditors don’t have to agree to a debt management plan and may still contact you asking for immediate repayment.

- Mortgages and other ‘secured’ debts are not covered by a debt management plan.

- Your debts must be repaid in full – they will not be written off.

- Paying over time may mean the amount you pay is increased

Bankruptcy

Bankruptcy is one way of dealing with debts you cannot afford to repay. It is a court order that you can apply for if you have unmanageable debts. It may be the best way for you to free yourself from excessive debts but the decision should not be taken lightly.

What is bankruptcy?

Bankruptcy is a legally binding form of insolvency, which gives you some relief from your debt in return for you agreeing to certain terms. To clear your debts, your assets are sold and split among creditors. While you are usually discharged from bankruptcy after a year, certain circumstances and disposable income may require you to pay into it for three years. You are protected from legal action and at the end of the term your outstanding debt is written off.

How long will bankruptcy last for you?

Bankruptcy normally lasts for 12 months. Once this has passed, regardless of what you owe, your bankruptcy will usually be discharged.

Will your credit rating be affected?

Your credit rating will be affected in the long term as the bankruptcy order will remain on your file for 6 years following bankruptcy.

What are the criteria for a Bankruptcy?

- You can’t afford to pay your debts

- The cost of bankruptcy is £680 – this fee can be paid in instalments to the Insolvency Service via gov.uk until the £680 fee has been reached, so you can pay it at a rate that’s affordable for you.

WHAT HAPPENS DURING A BANKRUPTCY?

- During the bankruptcy you cannot use your bank account, credit cards etc

- The official receiver must be given details regarding all financial affairs

- Creditors cannot take legal action against, or pursue you

- Details of your bankruptcy status may be published so creditors can submit a claim

- You cannot act as a director of a company until you are discharged (released) from bankruptcy. This is usually 12 months from the date the court made you bankrupt

- If you are self-employed, you can lose your business and employees may lose their jobs

- You are on an insolvency register until three months following discharge

Benefits

- Once you have completed the bankruptcy you will be completely free from any unsecured debts that were included in the bankruptcy proceedings.

- Bankruptcy provides automatic discharge after one year – less in some cases

Disadvantages

- Your assets, including your home and car, can be included and sold to raise money to repay creditors.

- You won’t be able to act as a director of a company.

- You will need court permission to take any part in the management of a limited company.

- If the official receiver believes it would help the investigation, members of your family, or employers could be scrutinised in court.

- It may be difficult to obtain credit in future, as a record of the bankruptcy order will stay on your credit history for up to six years.

Debt Relief Order

What is a Debt Relief Order?

A debt relief order is an alternative to bankruptcy for people struggling with debts of less than £30,000.

A debt relief order is only available to people who have a disposable income of less than £75 per month and personal assets worth less than £2,000.

Motor vehicles worth less than £2,000 will generally not be included in this limit (This is in addition to the general assets that you can have)

What debts count towards a debt relief order?

- Unsecured debt – Loans, credit cards, store cards, overdrafts, payday loans.

- Household debts – Rent, utilities, telephone, council tax.

- Finance – Hire purchase, credit agreements, buy now pay later agreements.

Who is a debt relief order suitable for?

Individuals with relatively low liabilities, small surplus income and few or no assets and who are possibly not in a position to pay off their debts in a reasonable time.

What are the criteria for a Debt Relief Order?

It costs £90 to arrange a Debt Relief Order and you can pay in instalments over 6 months. However, you need to have paid the fee in full before your application will be looked at. To qualify for a Debt Relief Order, you need to meet the following criteria:

- Your disposable income must be £75 or less.

- You have less than £2,000 in assets and your car is worth no more than £2,000.

- Your debt totals less than £30,000

What will a Debt Relief Order mean to me?

- Discharge of a DRO usually occurs after a year

- Your name is placed into the insolvency register

- You are removed from the insolvency register after three months but your credit rating will be affected for at least 6 years following

- All debt is frozen while in the DRO

- Legal action against you cannot be taken while in the DRO nor can creditors pursue you

- A DRO can seriously affect current and future employment

Trust Deed Fee’s

How much does an Trust Deed?

The Trust Deed fees will have been fully explained by your advisor and will be detailed in your IVA proposal. But, if, at any time, you do not feel you fully understand the fee structure we have in place, please contact us and we will explain the cost in more detail.

The fees charged for initiating and supervising your Trust Deed are included in the agreed amount you pay each month into your arrangement. There are no additional or hidden Trust Deed costs.

There are two sets of fees which are charged for an Trust deed: The Nominee’s fee and the Supervisor’s fee. No other fees are charged.

The Cost of a Trust Deed: Nominee’s Fee

The Nominee’s fee covers the time and expertise needed to consult with you and establish your income and expenditure, assets and liabilities in order to put together the Trust Deed Proposal which is submitted to your creditors. The Nominee represents you from the beginning of your instructions to help you put a proposal to your creditors until the creditor’s meeting and, if the proposal is accepted, your Nominee becomes your Supervisor thereafter.

The Nominee’s fee can typically vary from £1,000 to £2,500 depending on your creditors agreement. This will be drawn over the first year of the arrangement (usually within the first five months).

If you are a sole trader, partner in a business or have complicated affairs, the Nominees fees may occasionally be higher – but we will explain the reasons for this if they are higher than as previously stated.

The Cost of a Trust Deed: Supervisor’s Fee

In addition to the above, following approval of the Trust Deed, a monthly Supervisor’s fee will be taken. The Supervisor’s fee covers the specialist work carried out throughout the duration of your Trust deed (normally a five year period) to ensure it is managed correctly and ethically. You will have appointed a Personal Supervisory Advisor who will manage the day to day running of your account who is qualified to help you should any changes to your circumstances affect your ability to pay your monthly Trust Deed contribution. Furthermore, your Supervisor will conduct annual reviews throughout your Trust Deed term to ensure payments are still affordable and to address any variations that may be needed.

The Supervisor fees are never more than a maximum of 20% of all the contributions you make over the period of the Trust Deed, taken monthly, in fulfillment of the supervisory role.

The Cost of Trust Deed Advice

We don’t make any charge to you for any debt advice given prior to the Trust Deed being prepared, however if a Meeting of your Creditors has been arranged and you decide not to proceed, our partners reserve the right to charge you £250 to recover costs and disbursements that we have incurred. There are never any other charges whatsoever.

If, in the unlikely event your proposal is refused by creditors, we do not make any charge to you. We will suggest an alternative program to you which may be acceptable to your creditors at that time.

www.trustdeedpeople.co.uk is a trading style of Lawson Fox Debt Solutions Ltd. 3rd Floor, Falcon Mill, Handel St, Bolton BL1 8BL. Tel: 01204 804 000

Registered in England & Wales Company Number 07319288.

We provide Insolvency solutions to individuals throughout the UK; specialising in Individual Voluntary Arrangements which comply with the IVA protocol

Gerard Nicholas Ratcliffe is authorised by the institute of Charted Accountants in England & Wales to act as a Licensed Insolvency Practitioner. IP Number 8666

ICO Number: Z3070317

Lawson Fox Debt Solutions Ltd does not generate leads for resale.